2016-2017 TAX PLANNING GUIDE

Time to Plan Your Year-End Taxes

Click here to download this whitepaper.

The simple word “taxes” can make people squirm as they think about all the details they need to address. But, with some forward-looking planning, managing your taxes doesn’t have to be as difficult as it can seem.

The simple word “taxes” can make people squirm as they think about all the details they need to address. But, with some forward-looking planning, managing your taxes doesn’t have to be as difficult as it can seem.

As we move into an economy governed by a new president, tax strategies will inevitably change for future tax years. Fortunately, this past year brought positive trends, such as increased GDP output¹, unemployment claims at a 43-year low², and more, meaning our new president inherited a more robust economy. Though we won’t know precisely what the 2017 tax environment will be, you can still create efficiency in your tax planning this year.

Our tax guide offers you tips you can do today to address your tax planning needs. Before you act on any strategies in this report, we encourage you to consult with your tax professional about the options that are right for you. If you don’t currently have a CPA that you work with, we at Grace Tax Advisory Group are happy to introduce you to our comprehensive tax preparation and tax planning services.

What’s in store for 2017?

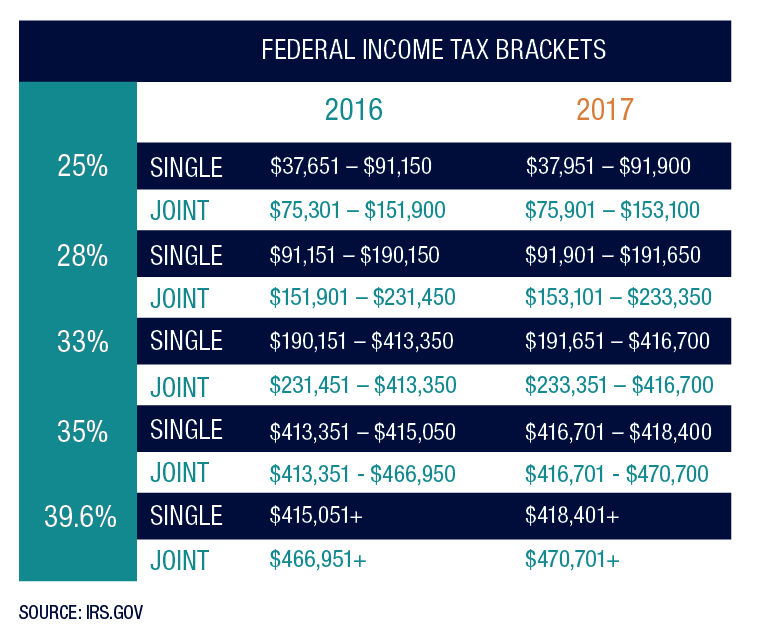

The IRS recently announced its inflation adjustments for the 2017 tax year, which we summarize below.

ACTIONS YOU CAN TAKE

Get Organized

Now is an excellent time to get your financial house in order. Gather cash receipts to help you calculate possible deductions and miscellaneous payments.

Ask yourself these questions:

• Do you have a hobby or activity that generates reportable income? If so, any losses might be eligible for a deduction.

• Have you made home improvements or charitable donations?

Collect all your documentation early to make your life a little easier in April. And consult a tax professional to discuss your personal situation.

Contribute Maximum Amount to Retirement Accounts

You have until April 18, 2017, to contribute your maximum amounts to your IRA accounts. (Dates may vary by state.) The sooner you contribute the money, the sooner the amount can start growing tax deferred. Making deductible contributions also reduces your taxable income for the year. In 2016 and 2017, you can contribute a maximum of $5,500 per person, plus an extra $1,000 if you’re 50 and older. You can split this limit between a traditional IRA and a Roth IRA, if you desire; the combined limit is still $5,500, or $6,500 if you are over 50.³

Check Your IRA Distributions

Following the year you turn 70 1/2 years old, you are required to take minimum distributions from your traditional IRA by April 1. So, if you turned 70 on August 10, 2016, you’ll turn 70 1/2 on February 10, 2017 — and you will need to take your first Required Minimum Distribution (RMD) by April 1, 2018. Thereafter, you’ll need to take your RMD by December 31 each year. Not distributing enough money triggers a 50% excise tax on the amount you should have withdrawn. This amount is based on your age, life expectancy, and the account’s balance at the beginning of the year.[4] Keep in mind that if you wait until April 1, 2018, you’ll still need to take a RMD for 2018, by the end of 2018.

To avoid headaches and penalties, mark your calendar with the following key dates:[5]

January 16, 2017

4TH QUARTER 2016 ESTIMATED TAX PAYMENT DUE

If you are self-employed or have other fourth-quarter income that requires you to pay quarterly estimated taxes, postmark this payment by January 16, 2017.

April 18, 2017

2016 INDIVIDUAL TAX RETURNS DUE

Most taxpayers have until April 18 to file tax returns. E-mail or postmark your returns by midnight on this date.

INDIVIDUAL TAX RETURN EXTENSION FORM DUE

If you can’t file your taxes on time, file your request for an extension by April 18 to push your deadline back to October 16, 2017.

1ST QUARTER 2017 ESTIMATED TAX PAYMENT DUE

LAST DAY TO MAKE A 2016 IRA CONTRIBUTION

If you haven’t already contributed fully to your retirement account for 2016, April 18 is your last chance to fund a traditional IRA or a Roth IRA; however, if you received a filing extension, you have until October 16 to contribute to a Keogh or SEP plan.

June 15, 2017

2ND QUARTER 2017 ESTIMATED TAX PAYMENT DUE

September 15, 2017

3RD QUARTER 2017 ESTIMATED TAX PAYMENT DUE

October 16, 2017

EXTENDED INDIVIDUAL TAX RETURNS DUE

If you received an extension on your 2016 tax return, it must be postmarked by

October 16, 2017.

LAST CHANCE TO RECHARACTERIZE 2016 ROTH IRA CONVERSION

If you converted a traditional IRA to a Roth during 2016 and paid taxes on the conversion on your 2016 return, this is the deadline for undoing the conversion.

IMPORTANT TAX ISSUES & UPDATES FOR 2017

Social Security Tax Caps

The current Social Security tax cap is at 6.2% for most employees. In 2017, however, the maximum taxable earnings amount will increase from $118,500 to $127,200. The IRS estimates that this increase will see 12 million people paying more into Social Security as a result of this change.[6]

Affordable Care Act Penalties

In 2014, the United States experienced major changes to health care. The Affordable Care Act requires all Americans to maintain health insurance. Taxpayers without health insurance (or coverage under someone else’s policy) will be assessed a penalty of 2.5% of household income, or $695 per adult and $347.50 per child in 2016 and 2017, whichever is greater (up to a maximum of the national average premium of a bronze plan or $2,085).[7]

Medical Expense Deductions

Until December 31, 2016, the threshold for deducting medical expenses is 10% of your adjusted gross income (AGI). However, taxpayers (or their spouses) age 65 and over are exempt from the 10% rule and may continue to claim 7.5% through the end of 2016. After January 1, 2017, all taxpayers must claim 10%.[8]

Alternative Minimum Tax (AMT) in 2017

In 2013, Congress permanently indexed the AMT for inflation. For 2017, the IRS raised the AMT exemption amount to $54,300 for individuals and $84,500 for married couples filing jointly.[9]

PEP and PEASE In 2017

PEP and PEASE are two provisions that increase the tax burden on wealthy taxpayers by limiting personal exemptions and deductions. The PEP and Pease income thresholds increase in 2017 to $261,500 for single filers and $313,800 for joint filers.[10]

Fatten Your Employer-Sponsored Plan

Tax-deferred investing is a smart choice because you grow your money tax-free until you withdraw it. Maximize your 401(k), 403(b), 457, and TSP contributions, which are limited to $18,000, or $24,000 if you will be age 50 or older in 2016.[11]

Weigh the Benefits of Harvesting Losses

To avoid paying capital gains taxes, many investors sell off investments (such as stocks) that have experienced losses in order to help offset any taxable gains realized during the year. If you think that you might have a heavy capital gains burden this year, talk to a tax expert and your financial professional about whether loss harvesting may be a good strategy for you.[12]

Pay Attention to Your FSA

Remember that you can take tax-free withdrawals from Flexible Spending Accounts (FSA) for qualified medical, dental, and child care costs in 2016 and 2017. Depending on your employer’s policies, you may lose any balance left in these accounts at the end of the year, so take advantage now by filling prescriptions early, making medical or dental appointments, or scheduling elective surgeries. This is also the time of year when you might need to specify how much salary you’ll contribute to your FSA. In 2017, the annual limit for employee contributions to sponsored health FSAs is $2,600.[13]

Consider Accelerating Your Mortgage Payments

Unlike rent — which you pay in advance for the current month — mortgage payments represent money owed for the previous period. Your January 2017 mortgage statement is actually a bill for December occupancy and represents interest accrued in 2016, making it eligible for a tax break this year. By mailing that mortgage check in advance, you might qualify for an additional deduction in 2016. It may be wise to pay it early in December. That way your lender officially notes the payment to the IRS in 2016. Unfortunately, you can’t accelerate your mortgage payments for any other upcoming month because the IRS generally prohibits write-offs for prepaid interest. Keep in mind that everyone’s tax situation is different, and accelerating your mortgage payments may not pay off if you expect to be subject to the Alternative Minimum Tax (AMT). If you are unsure, discuss the matter with your tax professional.[14]

Be Charitable

If you itemize deductions, a gift to a qualified organization may entitle you to a charitable contribution deduction against your income tax — so the tax savings reduces the actual donation cost. For example, if you are in the 33% tax bracket, the effective cost of a $100 donation is only $67. As your income tax bracket increases, the real cost of your charitable gift decreases, making contributions more attractive for those in higher brackets. For a person in the highest tax bracket (39.6%), the actual cost of a $100 donation is only about $60. Typically, charitable donations are capped at 50% of your AGI, though lower limits may apply in some cases.[15]

Donate Items

This time of year, many people choose to donate items to charity instead of making a monetary contribution. Not only can donations prevent perfectly good items from getting wasted, but you can deduct them from your taxes as long as you have written documentation of the donation. Here are a few things you need to know about donating items:[16]

You’ll need a written acknowledgment from the charity for any donated item valued over $250.

• If you claim a deduction for an item worth over $500, you may need to include a qualified appraisal or be able to show that the item was in good working condition.

• If you donate a car, boat, or airplane to charity, special rules apply.

Give a Gift

Each year, you can also pass money to loved ones tax free. You can give up to the annual exclusion amount — $14,000 in 2016 and 2017 — to as many people as you like every year, without facing any gift taxes. Recipients never owe income tax on the gifts.[17] In addition to the annual gift amount for 2016, the IRS allows you to give up to $5.45 million during your lifetime or as part of your estate without paying taxes. In 2017, the estate and gift tax exemption will rise to $5.49 million.18 The IRS indexes this limit to inflation, and it will continue to rise each year, increasing the amount that you can gift to your loved ones without owing estate taxes.

Fund an Education

The IRS offers taxpayers several credits and deductions to help offset the cost of education. The American Opportunity Tax Credit was extended through 2017. This credit allows you to claim qualified expenses up to $2,500 in 2016.[19] Because a tax credit reduces your tax bill dollar for dollar, the government will give you up to $2,500 per year for each qualifying college student in your family. The Lifetime Learning Credit allows you to claim qualified expenses up to a maximum of $2,000 per tax return.[20] Keep in mind that income restrictions kick in for these credits, so check with your tax professional to see if you qualify. Also, the IRS now requires taxpayers to submit a Form 1098-T to show the amount paid in qualified tuition and expenses to claim education credits.[21]

Manage Your Medicare Taxes

If you use Medicare, you will also have additional taxes to manage beyond what’s automatically taken out of each paycheck by your employer. High-wage earners will have to pay an additional 0.9% on earned income above the thresholds of $200,000 for single filers and $250,000 for joint filers. You also could have a 3.8% Medicare tax on income generated from investments such as capital gains, dividends, and taxable interest.[22] These brackets are not indexed for inflation, so they will affect more taxpayers each year. If you’re in the affected income brackets, speak with your investment representative and accounting professional to discuss how the taxes will impact your tax burden this year.

Conclusion and Steps to Take

Click here to download this whitepaper.

Planning your taxes efficiently takes time, effort, and experience — something we know adds an additional layer of complexity to your busy life. One of the ways we help our clients is by working hard to provide tax-efficient investment strategies to minimize the effect to your bottom line. We also consider it our responsibility to educate you about details that could affect your financial future.

We hope that this report provides you with useful, relevant strategies to consider as you prepare to file your 2016 taxes. If you have any questions about your taxes or how tax-efficient planning may help reduce your burden, please give us a call.

Before you act on any strategies in this report, we encourage you to consult with your tax professional who can advise you on the specifics of your personal tax situation. If you don’t currently have a CPA that you work with, we at Grace Tax Advisory Group are happy to introduce you to our comprehensive tax preparation and tax planning services.

As always, we appreciate the trust you place in our firm, and we look forward to continuing to help provide the financial clarity you seek.

Sincerely,

Cheryl L. Charbonneau, CPA, CFP®, CGMA

CFO/Director of Tax Operations

Grace Tax Advisory Group, LLC.

Would someone you know benefit from receiving this communication? If so, call our office at 239-249-8888 and share with us his or her contact information, and we will be happy to send them a copy.

________________________________________

Footnotes, Disclosures, and Sources

Investment Advisory Services offered through Grace Capital Management Group, LLC, a Registered Investment Adviser.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Past performance does not guarantee future results.

Consult your financial professional before making any investment decision.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through these links. They are provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

1“GDP hits 2.9% in biggest gain in 2 years.” MarketWatch. http://www.marketwatch.com/story/gdp-hits-29-in-biggest-gain-since-mid-2014-2016-10-28

[Accessed November 23, 2016]

2“Jobless Claims in U.S. Decline to Lowest Level in Four Decades.” Bloomberg. http://www.bloomberg.com/news/articles/2016-11-17/jobless-claims-in-u-s-decline-to-lowest-level-in-four-decades [Accessed November 23, 2016]

3“Retirement Topics: IRA Contribution Limits.” IRS. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits [Accessed November 21, 2016].

4“Retirement Topics: Required Minimum Distributions.” IRS. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

[Accessed November 22, 2016]

5“Important Tax Deadlines and Dates.” TurboTax. https://turbotax.intuit.com/tax-tools/tax-tips/Tax-Planning-and-Checklists/Important-Tax-Dates/INF12059.html [Accessed November 22, 2016]

6“6 Social Security Changes Coming in 2017.” U.S. News. http://money.usnews.com/money/blogs/planning-to-retire/articles/2016-10-18/6-social-security-changes-coming-in-2017 [Accessed November 22, 2016]

7“If you don’t have health insurance: How much you’ll pay.” Healthcare.gov https://www.healthcare.gov/fees/fee-for-not-being-covered/ [Accessed November 22, 2016]

8“Deducting Medical Expenses for a Major Illness or Injury.” TurboTax. https://turbotax.intuit.com/tax-tools/tax-tips/Tax-Deductions-and-Credits/Deducting-Medical-Expenses-for-a-Major-Illness-or-Injury/INF12016.html [Accessed November 22, 2016]

9“IRS Announces 2017 Tax Rates, Standard Deductions, Exemption Amounts, and More.” Forbes. http://www.forbes.com/sites/kellyphillipserb/2016/10/25/irs-announces-2017-tax-rates-standard-deductions-exemption-amounts-and-more/#57daa509387a

[Accessed November 22, 2016]

10“2017 Some Tax Benefits Increase Slightly Due to Inflation Adjustments, Others Are Unchanged.” IRS. https://www.irs.gov/uac/newsroom/in-2017-some-tax-benefits-increase-slightly-due-to-inflation-adjustments-others-are-unchanged [Accessed November 22, 2016]

11“How Much Salary Can You Defer If You’re Limited to More Than One Retirement Plan?” IRS. https://www.irs.gov/retirement-plans/how-much-salary-can-you-defer-if-you-re-eligible-for-more-than-one-retirement-plan [Accessed November 22, 2016]

12“Morningstar’s Year-End Tax Planning Guide.” Morningstar. http://news.morningstar.com/articlenet/article.aspx?id=780164. [Accessed November 22, 2016]

13“2017 FSA Contribution Limit Rises to $2600.” Society for Human Resource Management. https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/2017-fsa-contribution-limits.aspx [Accessed November 21, 2016]

14“Cut Taxes With Early Mortgage Payment.” Bankrate. http://www.bankrate.com/finance/taxes/cut-taxes-with-early-mortgage-payment-1.aspx

[Accessed November 21, 2016]

15“Charitable Contribution Deductions.” IRS. https://www.irs.gov/charities-non-profits/charitable-organizations/charitable-contribution-deductions [Accessed November 22, 2016]

16“Eight Tips for Deducting Charitable Contributions.” IRS https://www.irs.gov/uac/eight-tips-for-deducting-charitable-contributions [Accessed November 21, 2016]

17“Frequently Asked Questions on Gift Taxes.” IRS https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes [Accessed November 22, 2016]

18“The IRS Announces 2017 Estate and Gift Tax Limits: The $11 Million Tax Break.” Forbes. http://www.forbes.com/sites/ashleaebeling/2016/10/25/irs-announces-2017-estate-and-gift-tax-limits-the-11-million-tax-break/#7f6d69a43fa1 [Accessed November 22, 2016]

19“American Opportunity Tax Credit.” IRS. https://www.irs.gov/individuals/aotc [Accessed November 22, 2016]

20“Lifetime Learning Credit.” IRS https://www.irs.gov/individuals/llc

[Accessed November 22, 2016]

21“American Opportunity Tax Credit: Questions and Answers.” IRS https://www.irs.gov/uac/american-opportunity-tax-credit-questions-and-answers

[Accessed November 22, 2016]

22“The Medicare taxes and you.” Fidelity. https://www.fidelity.com/viewpoints/personal-finance/new-medicare-taxes [Accessed November 22, 2016]